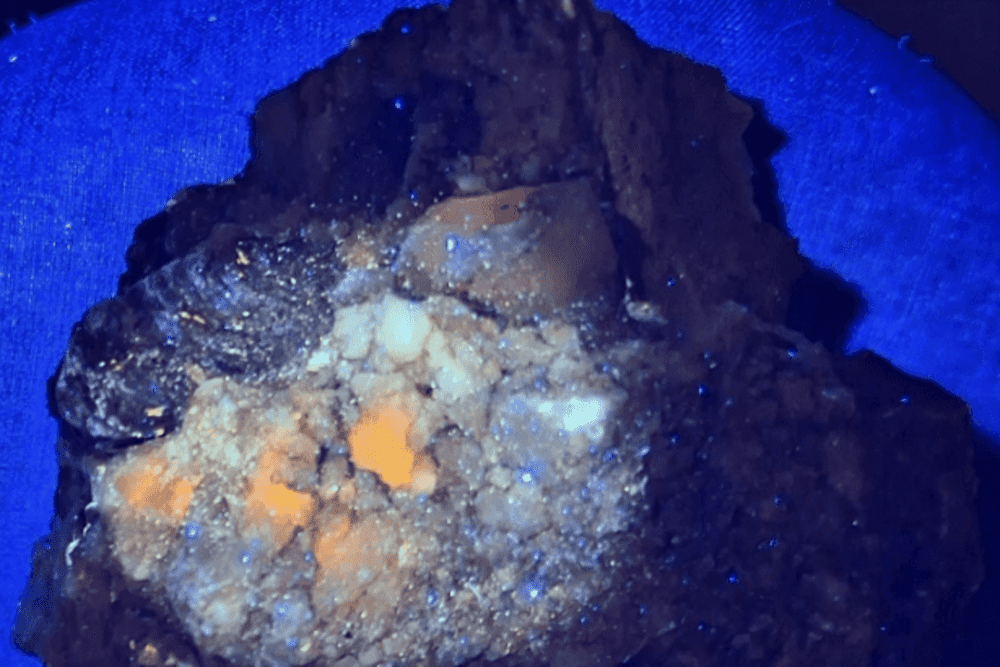

New Century Resources Limited has reached a major milestone, producing its 500,000th tonne of zinc concentrate since the recommencement of operations in August 2018.

The Century mine is located at Lawn Hill, Queensland, approximately 250 kilometres north-west of Mount Isa in the Lower Gulf of Carpentaria.

The mine initially commenced open-pit production in 1999 (under the operatorship of Rio Tinto [1]) and during its 16 years of operation, Century was recognised as one of the largest zinc mines in the world, producing and processing an average of 475,00 tonnes per annum (tpa) of zinc concentrate and 50,000tpa lead concentrates.

Rio Tinto sold the asset to MMG in 2016, who one year later sold the mine to New Century [1].

In November 2017, Sedgman Pty Ltd (a member of the CIMIC Group) in collaboration with New Century, completed a Restart Feasibility Study for Century. The study included a detailed economic analysis on a large scale tailings reprocessing operation utilising the significant existing infrastructure located on-site at the Century Zinc Mine.

In October 2018, New Century announced that the first zinc concentrate shipment (consisting of 10,000 tonnes of zinc concentrate) was officially underway from the restart of operations at Century.

Today New Century also revealed that it had executed a zinc price hedging program for the remainder of the 2021 financial year, with the company securing put contracts to guarantee a floor price of US$1.20/lb (US$2,645/t) for 100 per cent of sales in the March ’21 quarter and 50 per cent of sales in the June ’21 quarter.

According to the company, the securing of put contracts eliminates downside price risk while also providing full upside exposure to zinc prices above US$1.20/lb.

The hedging of zinc at a guaranteed floor price of US$1.20/lb captures strong tailwinds within the industry (December ’20 quarter average zinc price was up 12 per cent quarter-on-quarter to US$1.19/lb), with New Century expecting to deliver material growth in its adjusted EBITDA for the December ’20 quarter compared to the reported A$13.2 million for the September ’20 quarter.

In commenting on the news of the production milestone and hedging program, New Century Managing Director, Patrick Walta, said: “The milestone of producing 500,000 tonnes of zinc concentrate is a significant achievement for the company and testament to the efforts of our team on-site, as well as our strong culture and partnerships with stakeholders throughout the region.”

“In addition, New Century’s hedging program has successfully locked in the current buoyant market conditions for the remainder of the financial year, while also providing full exposure to further zinc price improvement,” Mr Walta commented.

“The company sees strong potential for zinc price upside, given the continued demand from growth within China and the likely near-term improved demand around the world as infrastructure-focused government stimulus packages are rolled out.”

“This demand is in contrast to continued global supply challenges, with traditional underground miners facing additional operational difficulties in improving production while also implementing social distancing and COVID-19 mitigation practices,” he said.

New Century intends to release its quarterly results near the end of January, following completion of its usual production and financial reconciliation process.

The company will also continue to assess opportunities for zinc price hedging throughout FY21 and beyond.