Business and Finance

A new executive program targeting women from culturally and linguistically diverse (CALD) backgrounds, is aiming to break down barriers and address inequalities experienced by women in the workplace. Monash Business School, together with MindTribes, an award-winning organisation that helps businesses harness both the human and commercial benefits of greater inclusion and diversity, will soon launch a series of masterclasses that are designed to inspire, teach and coach professional women from CALD communities, inclusive of First Nations women and those from migrant, refugee and asylum seeker backgrounds. Australian CALD women and First Nations women have a significantly lower rate of workforce…

Cannon Resources completes successful $6M IPO

Cannon Resources Limited (Cannon) will commence trading on the Australian Securities Exchange (ASX) today, following the completion of a successful, Initial Public Offer (IPO) to raise $6 million (before costs). The company has commenced an initial 4,000-metre diamond drilling campaign at its flagship Fisher East Project, located in the northern Goldfields region of Western Australia. A diamond rig has been mobilised to site, with the first hole currently underway at the Musket prospect, targeting extensions to existing, high-grade nickel mineralisation. Based on a review of previous work on the project, Cannon has an extensive, targeted drilling campaign planned at Fisher…

Anglo American and Salzgitter Flachstahl partner to advance green steelmaking

Aerial view of operations at Conceição Do Mato Dentro in Brazil. Image credit: Anglo American. Anglo American has signed a memorandum of understanding (MOU) with Salzgitter Flachstahl, a leading manufacturer of steel products, to collaborate on the decarbonisation of the steelmaking industry by exploring ways to reduce carbon emissions. The two companies intend to conduct research into feed materials, including iron ore pellets and lump iron ores, suitable for use in direct reduction (DR) steelmaking based on natural gas and hydrogen, a significantly less carbon-intensive production method than the conventionally used blast furnace (BF) process. The collaboration may also explore…

Capricorn acquires the Mt Gibson Gold Project

The Mt Gibson Gold Project – Orion Pit. Image credit: Capricorn Metals Ltd. Capricorn Metals Ltd has announced the execution and completion of two separate binding agreements (Acquisition Agreements) to acquire the Mt Gibson Gold Project (MGGP). The Mt Gibson Gold Project (MGGP) is located roughly 280 kilometres northeast of Perth and less than 10 kilometres from the main arterial Great Northern Highway, in the Murchison region of Western Australia. Gold production at the MGGP occurred between 1986 and 1999, when the project was placed on care and maintenance. It produced more than 868,000 ounces during this period. Capricorn notes…

BHP enters into nickel supply agreement with Tesla Inc

BHP has signed a nickel supply agreement with American electric vehicle and clean energy company, Tesla Inc. BHP will supply Tesla Inc. with nickel from its Nickel West operation in Western Australia, which it notes is ‘one of the most sustainable and lowest carbon emission producers in the world’. Tesla Inc. is the world’s largest manufacturer of electric vehicles and battery storage systems with a mission to accelerate the transition to sustainable energy, and nickel is a key metal used to manufacture Tesla Inc.’s battery technology. BHP Chief Commercial Officer, Vandita Pant, said demand for nickel in batteries is…

How are inflation expectations taking shape in the US vis-a-viz Australian economy?

The fear of inflation has been spooking investors across the world since the beginning of 2021 as the global economic recovery gathered momentum. While the inflationary concerns have been more prevalent in the US economy amid a steeper-than-expected surge in inflation numbers, the price pressures continue to remain subdued in Australia. In most parts of the world, investors have been encountering one of the biggest fears this year that inflation could run amok and impede the post-pandemic economic recovery. While such fears have substantially abated in recent days, rising fuel and property prices are indicating a further spike in inflation…

ABR appoints new Chief Executive Officer

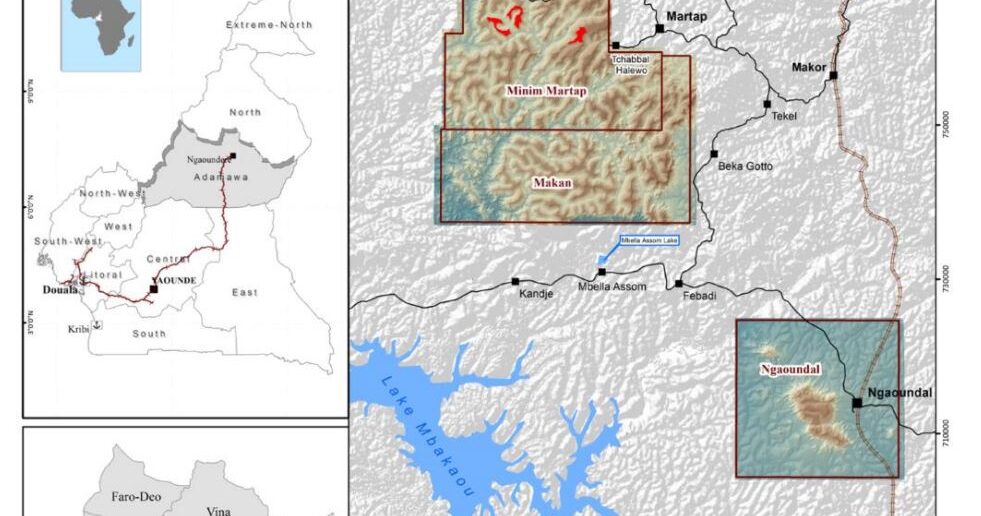

Location of the Fort Cady and Salt Wells Projects, courtesy of ABR. American Pacific Borates Limited (ABR) has announced the appointment of Henri Tausch as the company’s new Chief Executive Officer, commencing 9 August 2021. Mr Tausch has broad global business experience at Board of Director, CEO and COO level. Most recently he was a Senior Vice President and COO at TSX listed Shawcor Ltd, a global infrastructure and energy technology services company where he worked between 2011 and 2021. As COO he had global operations ownership with responsibility for the financial performance of all operating businesses. Prior to Shawcor…